Just how to Protect a Hard Money Funding: Steps to Simplify the Refine

Browsing the economic landscape can be challenging, especially when it comes to securing a Hard Money Financing. These car loans, normally made use of in actual estate purchases, require a clear understanding of individual finances, the lending market, and open communication with possible loan providers.

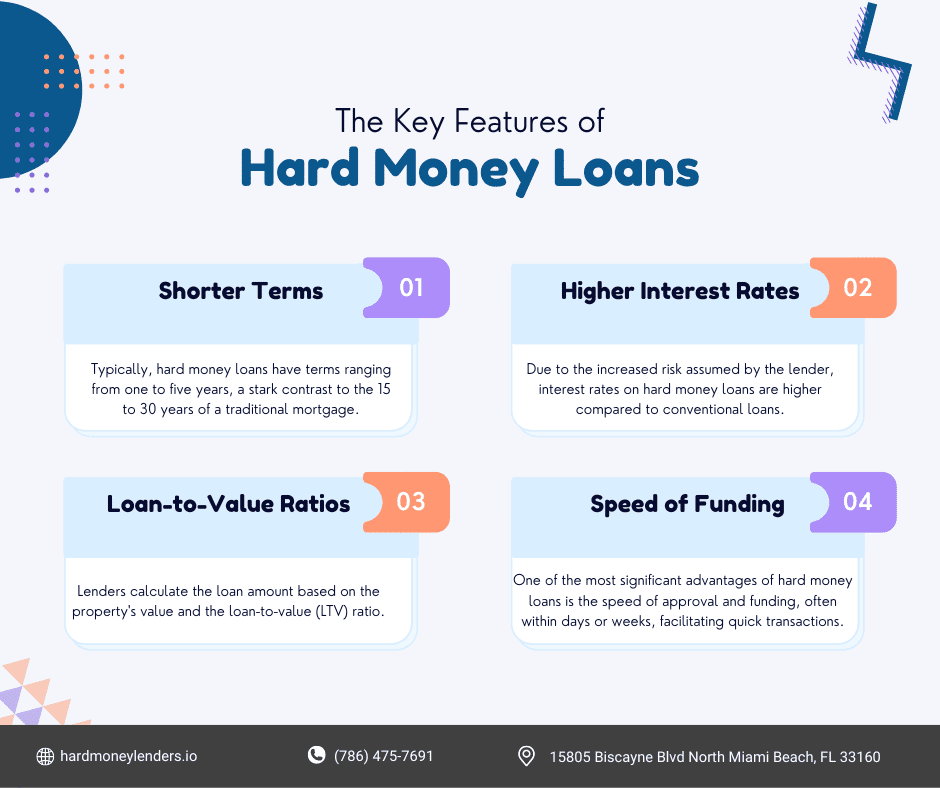

Understanding What Hard Money Loans Are

Tough Money financings, frequently viewed as the financial life raft in the huge sea of genuine estate, are a special type of financing. Unlike traditional financial institution finances, tough Money car loans are not mainly based on the borrower's credit reliability however instead the value of the building being purchased. Understanding these key functions is fundamental in navigating the stormy waters of hard Money financings.

Figuring out if a Hard Money Financing Is the Right Selection for You

Is a Hard Money Lending the ideal choice for you? In addition, if a rapid closing process is imperative, a Hard Money Finance can accelerate procedures, bypassing the lengthy authorization procedure standard lendings need. One have to be conscious that difficult Money lendings typically carry greater rate of interest rates.

Planning for the Funding Application Refine

Prior to getting started on the process of protecting a Hard Money Financing, it's necessary to adequately prepare. Applicants need to additionally be prepared to show their capacity to make Funding repayments. It's a good idea to perform a detailed building appraisal, as the worth of the residential or commercial property frequently identifies the Lending amount.

Navigating Interest Prices and Funding Terms

Navigating rate of interest and Finance terms can be a complex component of securing a Hard Money Lending. Recognizing rates of interest, decoding Finance terms, and discussing favorable conditions are vital facets to take into consideration. These aspects, when effectively comprehended, can considerably influence the general expense and price of the Finance.

Recognizing Rate Of Interest

A significant bulk of hard Money Funding applicants find themselves astonished by the intricacies of rates of interest. These prices are critical to recognizing the overall expense of a financing, as they determine the extra quantity debtors have to pay off past the principal. In the context of tough Money fundings, interest rates are commonly greater than those of standard car loans because of the inherent risk entailed. These fundings are usually temporary, asset-based, and function as a last resource for borrowers that can not safeguard funding from traditional loan providers. For this reason, loan providers charge a costs in the kind of high rates of interest to make up for the threat. Recognizing these prices aids borrowers in evaluating if a Hard Money Financing is a sensible service or if various other funding choices would certainly be extra cost-efficient.

Figuring Out Finance Terms

Translating the terms of a Hard Money Financing can usually seem like a difficult job. Loan terms, typically including the Financing amount, passion price, Funding duration, and payment routine, can substantially impact the consumer's monetary commitments. The interest price, commonly greater in difficult Money lendings, is an additional vital element to take into consideration.

Working Out Beneficial Conditions

Protecting beneficial conditions in a Hard Money Lending entails expert negotiation and a keen understanding of rate of interest prices and Loan terms. A customer ought to not shy away from discussing terms, doubting provisions, and suggesting adjustments.

Comprehending rate of interest is crucial. One need to understand whether the rate is repaired or variable, and just how it might vary over the Financing term. It's vital to safeguard a rate of interest rate that aligns with one's financial capacities.

In a similar way, Lending terms should be completely examined. Facets like settlement schedule, prepayment fines, and default effects have to be comprehended and worked out to prevent any future shocks.

Assessing and Picking a Hard Money Loan Provider

Choosing the appropriate tough Money loan provider is a crucial action in protecting a loan. hard money lenders in atlanta georgia. It calls for understanding the lending institution's criteria, evaluating their level of openness, and considering their adaptability. These elements will be checked out in the complying with sections to direct people in making a notified choice

Understanding Lenders Standard

Checking Lenders Transparency

This aspect is important as it ensures that click to read all Funding expenses, terms, and conditions are plainly connected and easily comprehended. It is recommended to request a clear, in-depth composed get more proposition detailing all facets of the Financing arrangement. In essence, the consumer's capability to understand the Loan agreement dramatically depends on the lender's openness.

Evaluating Lenders Flexibility

Ever taken into consideration the significance of a loan provider's adaptability when searching for a Hard Money Financing? Flexibility might show up in various types, such as versatile Funding terms, willingness to negotiate costs, or acceptance of non-traditional collateral. When safeguarding a Hard Money Lending, do not forget the element of loan provider versatility.

What to Expect After Protecting Your Difficult Money Funding

Once your tough Money Funding is secured, a brand-new phase of the loaning procedure starts. It is crucial for the consumer to recognize the terms of the Lending, including the interest prices and repayment routine, to stay clear of any unpredicted difficulties.

Tough Money lendings often come with greater interest prices than standard fundings due to their intrinsic threat. Hence, punctual payment is suggested to decrease the price. It's important to keep an open line of communication with the lender throughout this stage, guaranteeing any kind of problems are resolved quickly.

Final thought

In final thought, protecting a Hard Money Loan find out includes comprehending the nature of such financings, analyzing individual financial conditions, and finding a proper loan provider. These actions can lead people in protecting and effectively handling a Hard Money Financing.

Navigating passion rates and Financing terms can be a complex part of protecting a Hard Money Lending. In the context of hard Money car loans, passion prices are typically greater than those of typical finances due to the inherent risk included. Funding terms, normally encompassing the Lending amount, rate of interest rate, Lending duration, and repayment routine, can substantially impact the borrower's monetary commitments.Safeguarding favorable conditions in a Hard Money Loan involves expert arrangement and a keen understanding of rate of interest prices and Funding terms.In final thought, securing a Hard Money Loan involves understanding the nature of such lendings, examining personal economic circumstances, and locating an appropriate loan provider.